If you have seen headlines or social posts calling for a housing crash, it’s easy to wonder if home values are about to take a hit. But here’s the simple truth.

The data doesn’t point to a crash. It points to slow, continued growth.

And sure it’s going to vary by local area. Some markets will see prices rise more than others. And some may even see small, short-term declines. But the big picture is: home prices are expected to rise nationally, not fall, over the next 5 years.

The Real Story Is in the Expert Forecasts

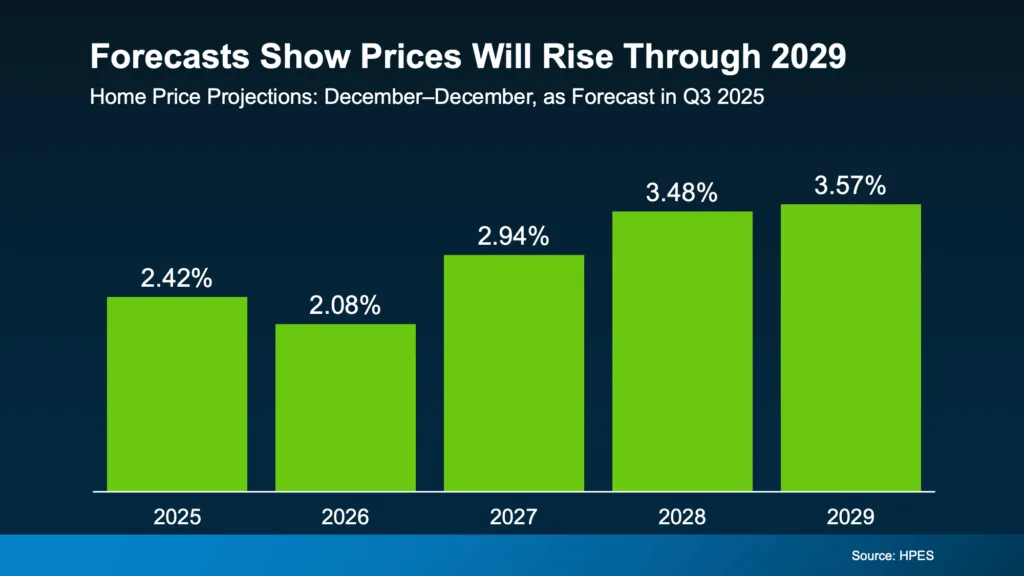

In the Home Price Expectations Survey from Fannie Mae, each quarter over 100 leading housing market experts weigh in on where they project home prices will go from here. In the report that was just released, the experts agree prices are projected to climb nationally through at least 2029.

Here’s how to read the visual. Each bar in that graph shows an increase, not a loss. It’s just that the anticipated pace of that appreciation varies year to year.

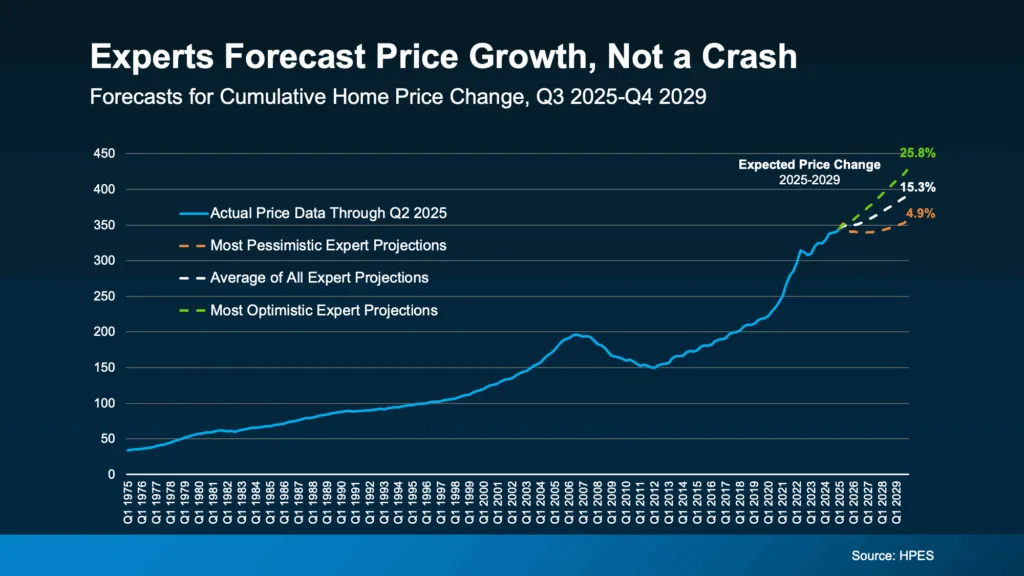

To further drive this home, let’s look at another view of where prices are and where they are expected to go. In this version, the expert forecasts are broken into 3 categories: the overall average, the most optimistic projections, and the most pessimistic projections.

Notice how even the most pessimistic forecasters say we will see prices rise by almost 5% over the next tew years.

- Overall, prices are expected to rise about 15% from now through the end of 2029

- The optimists say we’ll beat that and seea roughly 26% increase

- And even the pessimists anticipate prices will go up by 5% during that period

What sticks out the most? None of these groups who study the market are forecasting a crash, or even a decline, over the next 5 years.

How This Compares to “Normal” for the Market

Now focus back on the first graph. The projections call for 2-3.5% price increases in each of the next five years. For context, the average rate of appreciation for the last 25 years was closer to 4-5% annually. While that’s slightly below the historical average, it’s much more sustainable and typical than where the market was in 2020, 2021, and 2022.

Back then, prices rose too much, too fast based on record-low supply and record-high demand. Some prices even saw prices climb by 15-20%.

While it may feel like prices are stalling compared to those pandemic end surges, what’s really happening is that the market is finally finding balance again.

Why Prices Aren’t Expected to Crash

A lot of the chatter about home prices today is based on that rapid rise and the old saying that what goes up, must come down. But historically, that’s not really true. Home prices almost always rise.

The main reason we’re not heading for a repeat of 2008 is simple: supply and demand.

Even though affordability challenges have made it harder for some people to buy over the past few years, there still aren’t enough homes for everyone who wants one. That ongoing shortage is keeping upward pressure on prices nationally.

That’s why experts across the board can confidently agree: we’re not headed for a price collapse, but for steady, long-term appreciation.

Just in case it’s the economy that’s got you worried, remember this: Over the past 50 years, there have been plenty of economic events that have impacted the market. One thing that’s consistently been true throughout time is the housing market always recovers. We’re coming through that turn right now and going into a recovery.

Leave a Reply