Now that it’s September, all eyes are on the Federal Reserve. The overwhelming expectation is that they will cut the Federal Funds Rate at their upcoming meeting. This would be driven primarily by recent signs that inflation is cooling, and the job market is slowing down. But what does this mean for the housing market, and more importantly, for you as a potential homebuyer or seller?

Why a Federal Funds Rate Cut Matters

The Federal Funds Rate is one of the key factors that influences mortgage rates. Things like the economy, geopolitical uncertainty, and more also have an impact.

When the Fed cuts the Federal Funds Rate, it signals what’s happening in the broader economy. Mortgage rates tend to respond. While a single rate cut might not lead to a dramatic drop in mortgage rates, it could contribute to the gradual decline that’s already happening.

The Projected Impact on Mortgage Rates

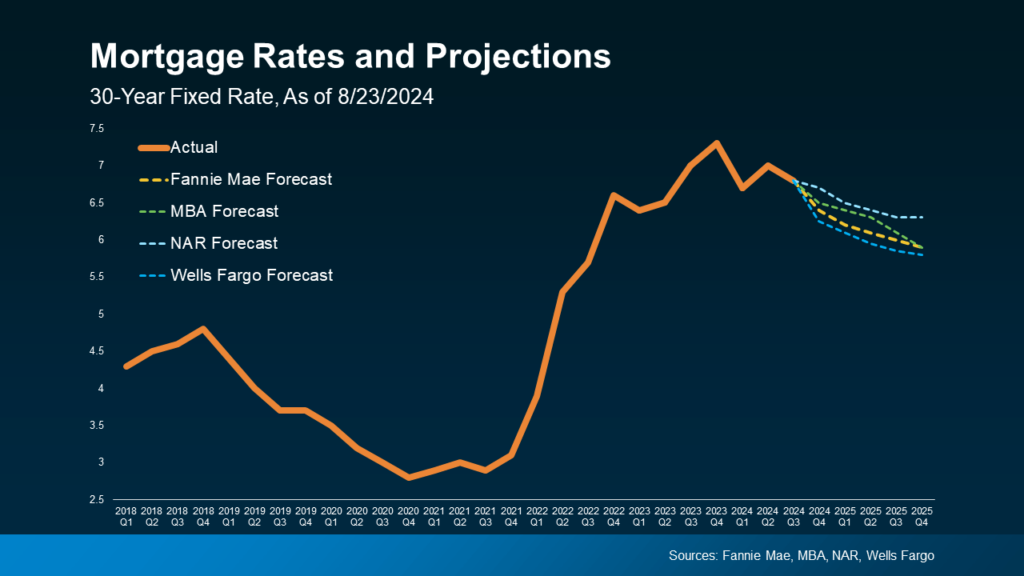

Here’s what experts in the industry project for mortgage rates through 2025. One contributing factor to this ongoing gradual decline is the anticipated cuts from the Fed. The graph below shows the latest forecasts from Fannie Mae, MBA, NAR and Wells Fargo.

So, with recent improvements in inflation and signs of a cooling job market, a Federal Funds Rate cut is likely to lead to a moderate decline in mortgage rates. Here are two big reasons why that’s good news for both buyers and sellers.

- It Helps Alleviate the Lock-in Effect

For current homeowners, lower mortgage rates could help ease the lock-in effect. That’s where people feel stuck within their current home because today’s rates are higher than what they locked in when they purchased their home.

If the fear of losing your low-rate mortgage and facing higher costs has kept you out of the market, a slight rate reduction could make selling more attractive again. However, this isn’t expected to bring a flood of sellers to the market. Many homeowners may still be cautious about giving up their existing mortgage rate.

2. It Should Boost Buyer Activity

For potential homebuyers, any drop in mortgage rates will provide a more inviting housing market. Lower mortgage rates can reduce the overall cost off homeownership, making it more feasible for you if you have been waiting to make a move.

While a Federal Funds Rate cut is not expected to lead to drastically lower mortgage rates, it will likely contribute to the gradual decrease that’s already happening. And while the anticipated rate cut represents a positive shift for the future of the housing market, it’s important to consider your options right now.

Leave a Reply