The premium that buyers usually have to pay for a brand new house is disappearing. A low supply of homes for sale is fueling the strange price dynamics between new and older properties.

Benefits of a newly built house

A newly built house normally costs more than an old one, but the higher upfront cost is offset by lower maintenance bills in the early years of ownership. The roof is new and the appliances are all at the start of their useful lifespan. Many builders also offer a warranty to fix structural problems that arise in the first year or two of occupancy.

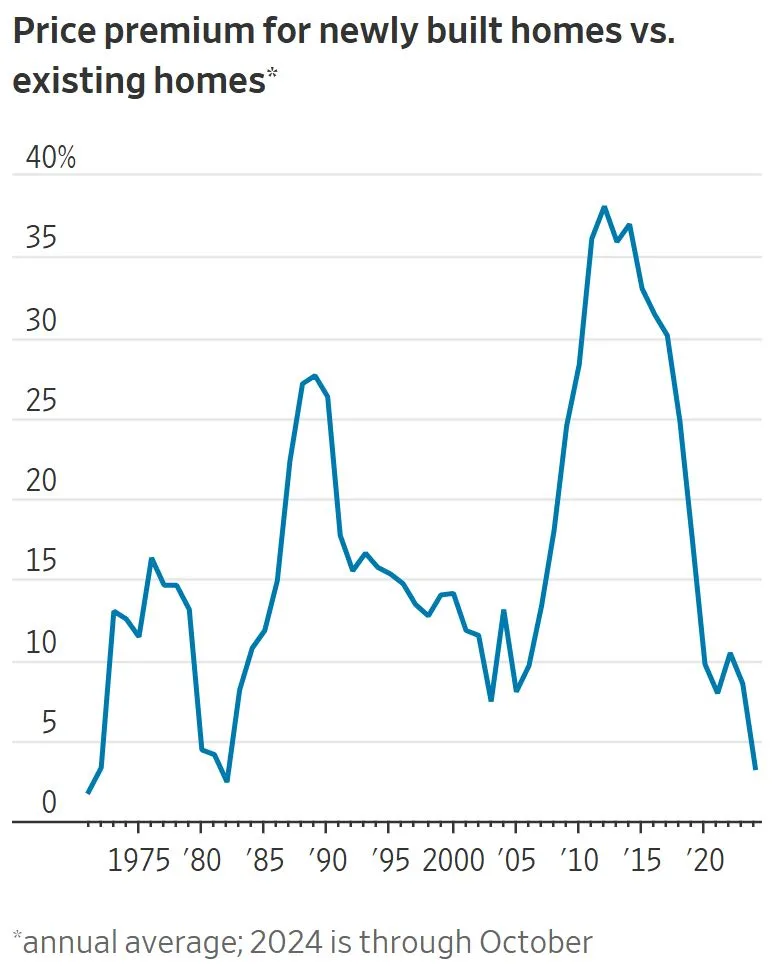

The new home premium bounces around but has been 16% on average since 1968. It has withered away since the pandemic era housing boom, though. This year through October, buyers have paid a 3% premium on average for a newly built home.

Prices are converging because new homes are getting smaller and simpler. Builders are swapping out pleasing touches and shrinking the floor size. New single family homes were 2,384 square feet on average in the third quarter of 2024. Many large builders want homes sold within two years of breaking ground. This minimizes the cost of holding them on their books. They will offer discounts to sell inventory.

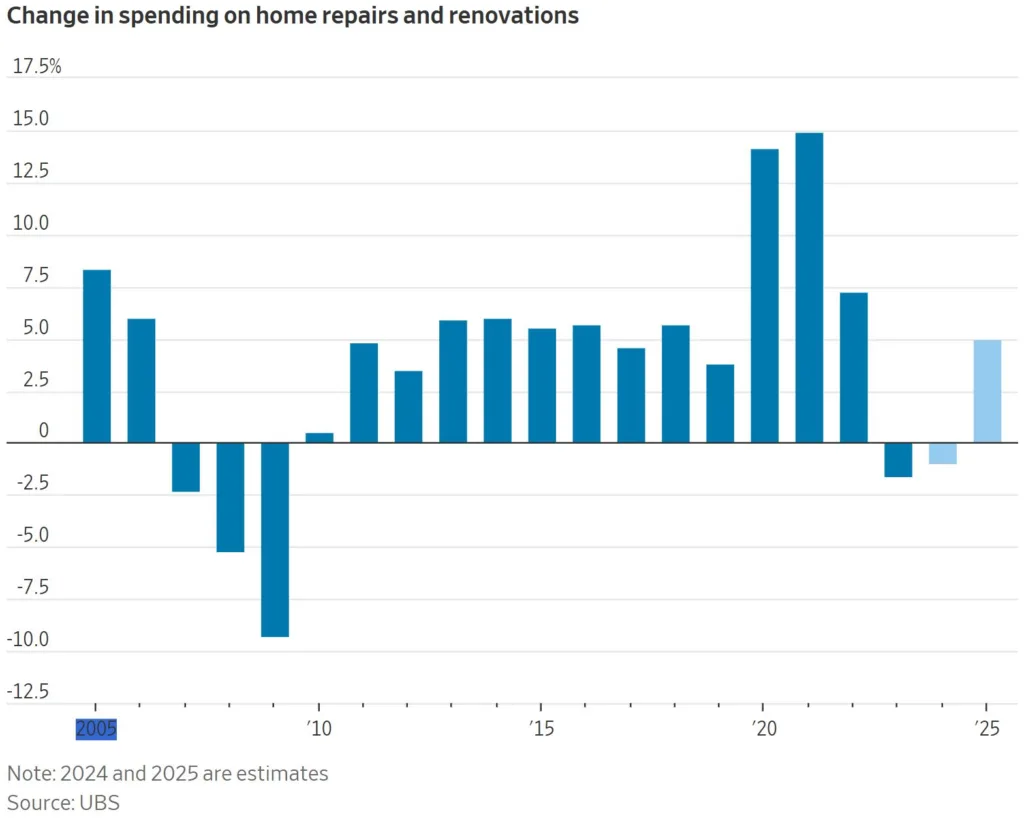

But buyers may be so desperate to move that they no longer consider the cost of fixing up an older house. Once a property reaches 25 years of age, major components and systems are likely to need replacing. Homeowners in properties built between 1970 and 1999 spend 26% more on annual maintenance than homes build after 2000. The costs to maintain a pre-1970 property are even higher.

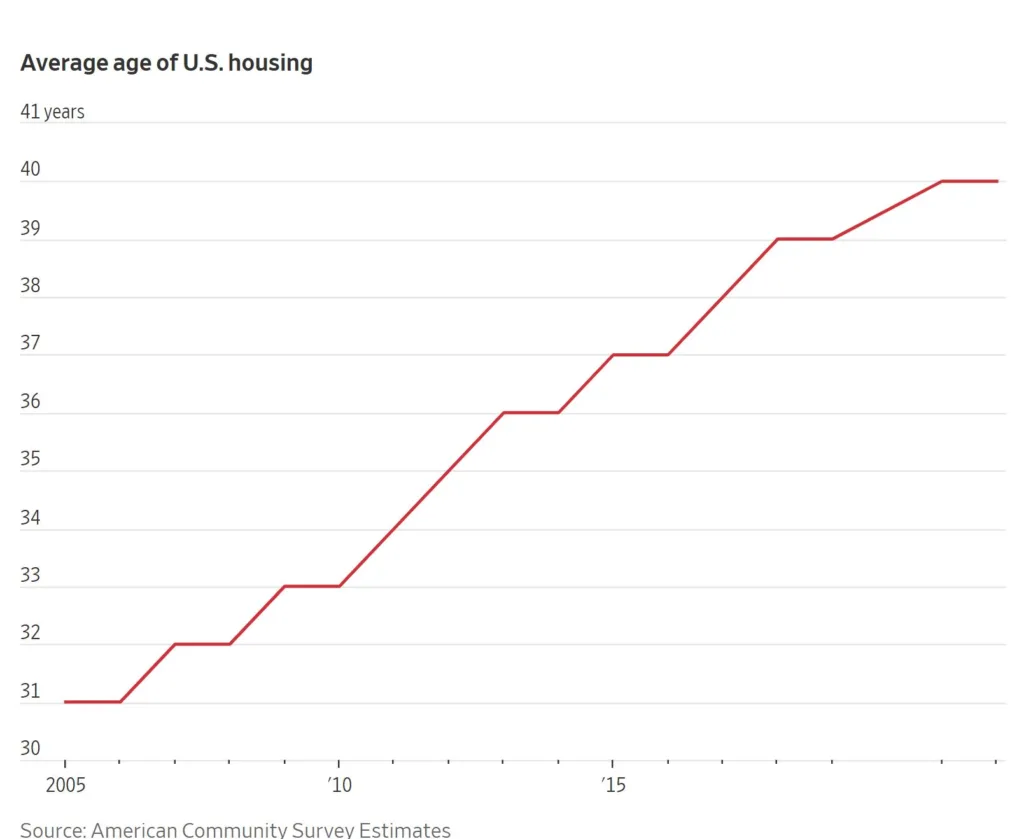

Repair costs are especially relevant because America’s housing stock is older than ever. As construction collapsed following the 2008-09 financial crisis, the average age of U.S. homes has crept up to 41 years from 32 years on the eve of the 2008 crash.

Add to this the fact that existing homes tend to be more expensive to keep warm and to insure. Old electrical wiring can increase fire risk and building techniques may no longer meet modern standards designed to protect homes from extreme weather.

In a healthy housing market, properties tend to lose value as they age if they aren’t renovated. This process helped lower income buyers between 2005 and 2013. The process was disrupted over the past decade when rock bottom interest rates and tight supply made all housing costlier. Today buyers have the worst of both worlds. America’s aging housing stock needs patching up but tis commanding record prices.

Leave a Reply